Do I Have To Pay Taxes On My Rv When I Register It In Fl

Motor Vehicles

Titles

All motor vehicles must exist titled and registered. Florida Statute 319.xl authorizes the DHSMV to issue an electronic certificate of title in lieu of a paper title. An electronic title may be converted to a paper title at the owner's request. The DHSMV will mail the paper title from Tallahassee to the possessor approximately ii weeks after it is ordered. The possessor may opt for an expedited paper title for an additional fee at a service eye.

Transfer of a Florida Title

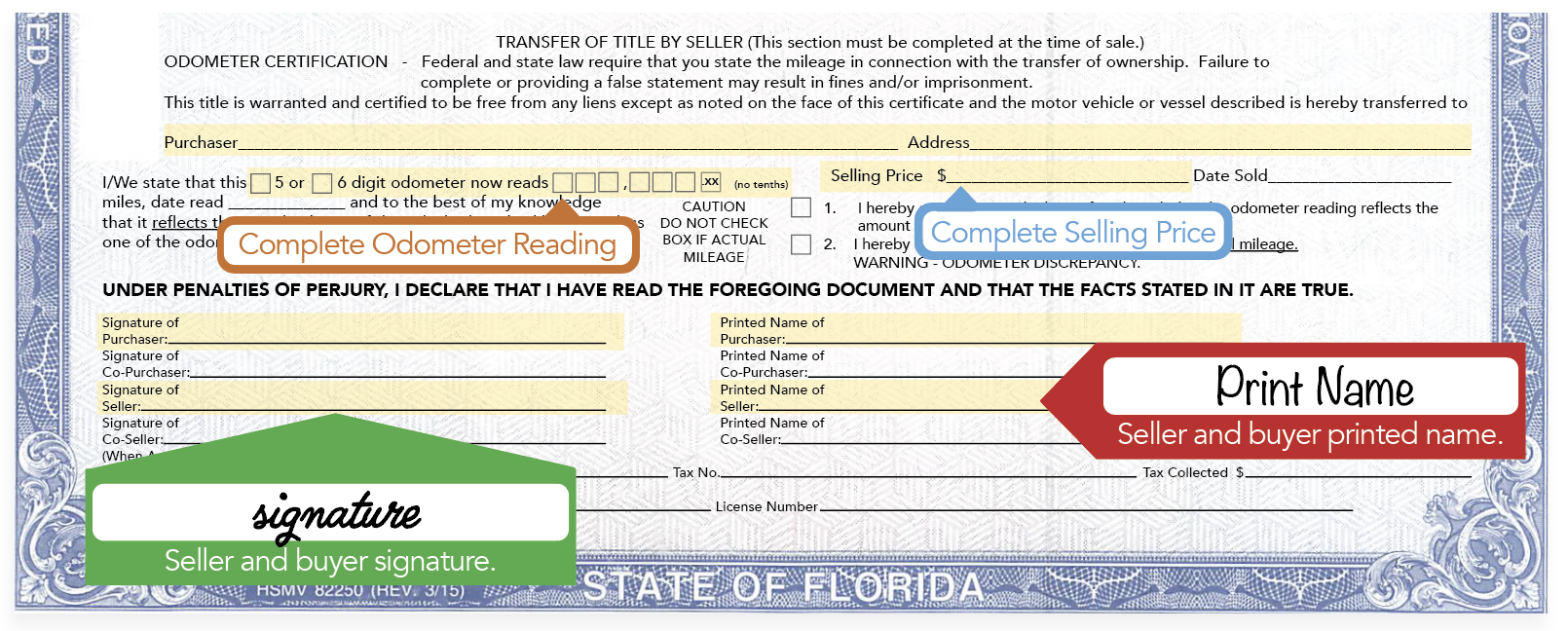

The seller(due south) must consummate the "Transfer of Title by Seller" section in full on the document of championship. This includes: the purchaser'due south name, selling toll, engagement of sale, and odometer reading with date read (when applicable). The seller(southward) and purchaser(s) must and so sign and impress their proper noun. Their signatures are not required to be notarized in this department, even if at that place is a labeled identify.

Transfer of an Out-of-State Championship

A customer with a motor vehicle, boat/vessel, or mobile home from out-of-state should have a certificate of championship equally proof of ownership. The transfer section on the out-of-land title must be properly executed by the seller if there is a transfer of ownership.

A client whose title is held by a lending establishment must provide their near electric current vehicle registration and the lienholder's name, address, and business relationship number.

We recommend that customers with a transaction involving a not-titled motor vehicle, gunkhole/vessel, or mobile dwelling house contact our office to address specific requirements.

Florida Statutes require that the vehicle identification number (VIN) on motor vehicles be verified. The VIN verification may exist completed on the Application for Document of Title with/without Registration (HSMV 82040), or a Vehicle Identification Number and Odometer Verification form (HSMV 82042).

Obtain a Duplicate Florida Title

The owner of a motor vehicle, mobile home, or gunkhole/vessel may obtain a indistinguishable Florida championship by completing an Application for Duplicate or Lost in Transit/Reassignment Championship (HSMV 82101). The owner must besides submit a lien satisfaction form (HSMV 82260) if records show a recorded lien against the certificate of title.

In the instance that a seller has lost a title and the purchaser will obtain a Florida title, both the seller and the purchaser may visit our office together and complete class HSMV 82101. This allows the seller to transfer buying without paying for an expedited championship or waiting for a championship to exist sent in the mail. Nonetheless, both duplicate and transfer of title fees will apply at the time of the transaction.

Sales Taxation

The Land of Florida has a state sales and use tax of vi%. Lake Canton has an boosted 1% Discretionary Surtax on the outset $5000 of the buy price for a maximum of $fifty. The Tax Collector, as an amanuensis for the Florida Department of Revenue (DOR), collects sales and use tax on transactions when a customer applies for a title or transfers a title to motor vehicles, mobile homes, and boats/vessels. If a motor vehicle, mobile home, boat/vessel is traded in, sales revenue enhancement is collected on the difference between the buy price of the vehicle and the gross trade-in allowance. Some exemptions to sales taxation apply.

Registrations

Motor vehicles, boats/vessels, and trailers are registered co-ordinate to the owner's birth month. The registration is valid until midnight on the owner's birthday. When a vehicle is registered in multiple names, the altogether of the person whose name appears first on the championship volition determine the registration expiration. A delinquent fee will be charged on all registrations not renewed by the 10th calendar day of the month post-obit the expiration month. (Per Florida Statute 320.07(4))

The post-obit is a list of some exceptions to birthday expirations:

- Vehicles titled in the proper noun of a company elapse on June 30th

- All mobile homes (not declared equally real property) expire on Dec 31st

- Trucks over 8000 pounds, tractors, semi-trailers, and nine+ passenger vehicles for hire expire December 31st

An Initial Registration Fee of $225 may be imposed, unless the owner is otherwise exempted, for the showtime time registration of individual automobiles, motor homes, and pickups/trucks weighing 5,000 pounds or less.

Proof of Insurance

Proof of Florida insurance is required to purchase and renew a license plate in Florida. The vehicle possessor must provide proof of personal injury protection (PIP) in the amount of $x,000 and combined actual liability and belongings damage liability in the amount of at least $ten,000.

Proof of insurance is not required to be presented at the time of buy or renewal of license plates for motorcycles, mobile homes, and trailers. However, this is a statement of procedural fact and is in no mode intended to propose that insurance should not be carried. Additional Data virtually Insurance

Source: https://laketax.com/motor-vehicles/

Posted by: melosolivocks.blogspot.com

0 Response to "Do I Have To Pay Taxes On My Rv When I Register It In Fl"

Post a Comment